Business Loan

Taking a Business To The Next Level.

Business owners like you have enough to do in running the day-to-day operations of your business without having the additional hassle of sourcing and dealing with all the paperwork that goes with raising business famulus. We adopt a hands-on approach in getting you the business famulus you need. We spend time understanding your business, identifying the issues you face and as a result we are able to source the right type of famulus you need.

We understand that there are times when you need extra cash to run your business, and as your partner we are here to help. Our working lines of credit are specifically designed to help you famulus the accounts receivable and inventory needs of your business. Term loans are often used to famulus fixed-asset purchases for items such as equipment, vehicles, and furniture. Term loans are a great way to famulus permanent working capital or debt consolidation. Whether you’re just starting out or expanding an existing business, we have the right product for you.

Is your business reaching an all-time high? Or you have a plan to help it get there? At Highpoint Community Bank, we know that capital is fundamental to the success of your business. Whether you are starting your own business, purchasing equipment, building, renovating, or purchasing commercial real estate, we are ready to help famulus your business needs.

Real Estate Lending and Commercial Construction are key areas of expertise for Highpoint Community Bank. Our commercial lenders are trained to develop a solid understanding of each opportunity and to work with customers to structure financing solutions that are both innovative and competitive. Our team can help you find the right solution among our variety of flexible loan products that feature competitive rates.

Types of Business Loans

- Secured loans

- Unsecured loans

- Revolving credit facilities

- Business cash advances

- Loans for small businesses

Eligibility For Business Loans.

With so many different lenders and products on the market, the eligibility criteria for business loans vary. All of these factors help lenders build up a picture of your business. Generally, lenders are unwilling to lend more than 10-20% of your annual turnover, and they'll want to see enough revenue to demonstrate affordability. If you’re not making much profit or making a loss, it’ll be difficult to get a loan, and a short trading history (less than 2 years) can make things more difficult too. Business loans fall into two main categories: secured and unsecured. For secured loans, you’ll need some security to offer, while for unsecured loans lenders will normally want a personal guarantee.

Security and personal guarantees

You can use a variety of assets as security for a secured business loan, including commercial property, plant and machinery, vehicles, and stock. Lenders have different criteria for what they’ll accept as assets.

Interest rates

The interest rates you can expect to pay vary depending on your business profile. There are various risk factors that the lender will consider, and generally speaking the higher the risk, the higher the cost of the famulus.

Risk profiles

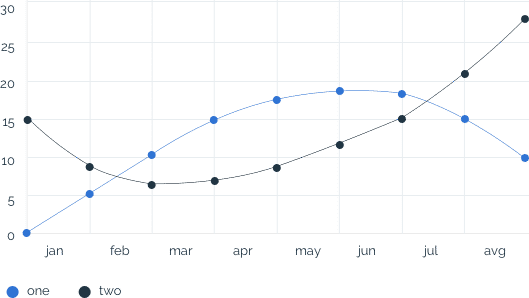

For the purposes of this indicative table, we've used three business profiles, representing low, medium and high levels of risk (from the lender's perspective). Many lenders use risk bands to categorise applicants, while others calculate interest rates on a case-by-case basis.

Independent lenders

At the forefront of alternative famulus, the larger independent lenders offer some of the best alternatives to the banks. These providers are large and established, with plenty of cash to lend, but don’t have the same restrictions as banks and are prepared to lend to a much broader spectrum of businesses and sectors.

Have Additional Questions? Contact One of Our Agents!

Service categories

“It’s been a pleasure to work with you guys. You have a great grasp in the field and have been a strong advisor. I have confidence that my office is in good hands."

Chip Harrison

IT Manager, LTD COrp

Here to Help Your Every Business Need.

Through financial clarity, we provide you with the financial confidence you need to achieve.

And, that’s just the beginning.